The Consumer Is Your Customer

By Jeff Corbett

A post in which I further posit that consumer enabled technology, that is, products and services who count the consumer as a user, can help overcome the typical growth related hurdles most proptech companies face.

The Hurdles

Any company that has developed software for real estate agents has likely run into growth issues due to:

- A Total Addressable Market (TAM) that’s both segmented and a fraction of the raw number of licensed agents, which leads to…

- Serving multiple masters, which leads to…

- Challenges around overall adoption.

The term proptech covers a lot of categories across the greater real estate industries (residential, commercial, construction, etc). For the purpose of this article, when I write proptech I’m referring to the cohort of companies who develop technology driven tools and services used by real estate settlement service providers, most specifically real estate agents, to help complete all aspects of the transaction cycle.

Total Addressable Market

Any technology company considering the real estate space as their primary, secondary, or tertiary market will quickly hear that the industry’s true TAM is a fraction of the current number of licensed agents. The majority of agents are involved in fewer than one transaction per year, and about 70% of agents cycle out of the industry every five years. New folks cycle in, but that level of non-production and potential churn can be crushingly expensive for a software company. For these reasons investors in proptech are almost always looking for product applicability in one or more adjacent markets. The presence or at least the potential of economies of scope and scale are almost requirements.

You can also break the TAM into three primary segments:

- The Traditional Brokerage: A business model that makes money primarily by splitting commissions with and/or charging fees to agents. The traditional brokerage competes with other brokerages to recruit and retain agents by offering attractive commission splits and access to resources such as technology, marketing, and training. Agents in a traditional brokerage generally compete with each other for the same customers. If you follow the money, the traditional brokerage’s customer is an agent as much as it is a consumer.

- The Real Estate Team: A business model where a collaborative team of real estate agents services the same customers. Each agent typically specializes in a role matched to their skills—e.g., an inside sales agent (pre-qualifies potential buyers and sellers), buyer or seller specialist, transaction management coordinator, closing specialist, etc. There is a high level of accountability between team members. The customer is almost always the consumer.

- The Individual Agent: Individual agents often work for a traditional brokerage or are brokers themselves, allowing them to run an independent business. They may have assistants to help qualify prospects or manage transactions. Their customer is the consumer.

Yes, each of the above segments can be further defined into sub segments and far greater detail. My point is that each of the 3 primary segments tend to have very different business requirements when it comes to product needs (and wants). To make things even muddier, each segment is not mutually exclusive of another. Traditional brokerages can include teams and agents and so on.

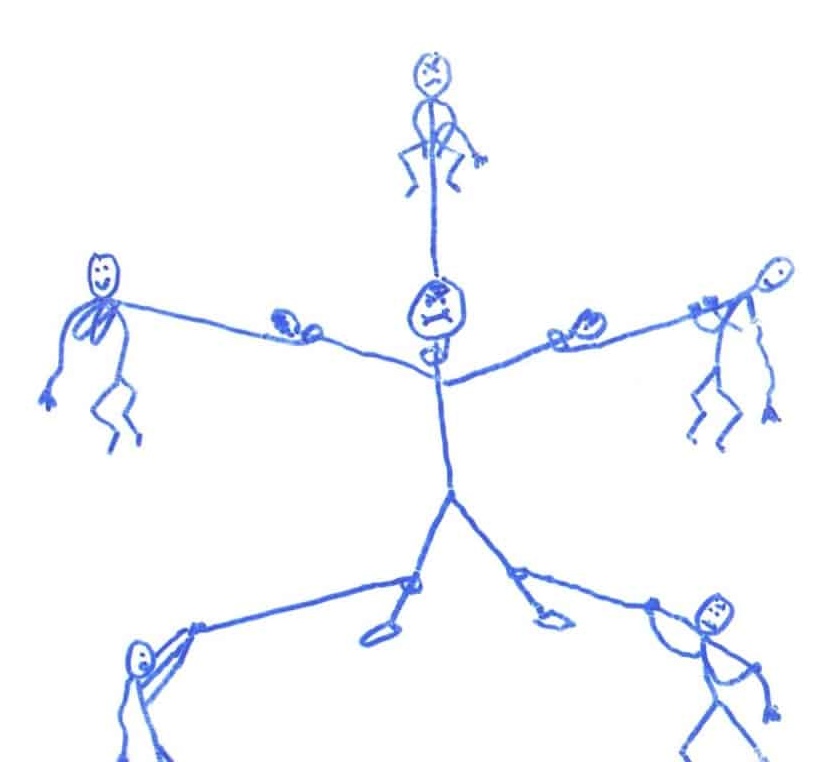

Serving Multiple Masters

I’ve worked with a company that developed an industry leading website, Customer Relationship Management (CRM) and marketing automation platform. The platform was developed to convert leads into clients and required dedicated internal resources who followed our prescribed best practices to realize success. It was also a comparatively expensive product because we invested heavily in the product and provided extensive training and support to every client. The size of the client services division of the company exceeded the size of the sales team, which is uncommon.

These factors attracted the well run real estate team because of their collaborative business model and higher production levels. Growth in this segment was explosive and we became the category leader. At one point, around 40% of the top real estate teams (ranked by a third party) were using the platform. Then we started hitting our head against a growth ceiling because there are only so many top-producing teams.

If you’re not growing, you’re dying, so the company began developing product with an individual agent (lower) price tag on it. A lot of initial growth was succeeded by high churn (compared to the core team level product). The agent product also stretched internal client service resources thin. I’m speaking frankly here when I say that the individual agent product brought in a less sophisticated client, and at a lower price point. Clients that demand more resources, churn out at a higher rate, while yielding less revenue on a per account basis is a challenging problem to solve for.

Product also began developing features to appeal to large traditional brokerages, which often didn’t align with the needs of teams or individual agents. But traditional brokerages are comparatively revenue-rich clients—they know this and will flex accordingly. With competing customer requirements, product roadmaps can get pretty winding.

At the same time, category competition began to catch up and Product had to account for feature parity with said competition, which can stifle innovation in a lot of ways. Instead of developing a product that solves an agent’s needs you get caught developing what they want which often doesn’t align with delighting the consumer, the party who ultimately pays the bills.

As an example, some of the early and popular Product releases were focused on engaging prospective customers (consumers) in highly relevant ways which lead to higher conversion rates. Some examples:

- An improved experience around saving property searches and emailing customers when new properties that fit their prescribed criteria hit the market. The agent didn’t have to manually do this job via the MLS anymore and the consumer appreciated the targeted and timely communications.

- An algorithm that identified when a prospective customer searching for property had engaged in the types of behavior over a certain time frame that signaled to an agent that they should reach out to said prospect and why. These folks were far more likely to subsequently engage an agent.

- The ability to construct ‘smart’ drip email campaigns that automated what communications were sent based on a series of that prospect’s behaviors and some conditional logic. This led to higher open, click-through, and ultimately conversion rates.

These features are all very common today, but were innovative back then, but that’s not my point. My point is that no broker-team-agent asked for these product features. They were the result of copious amounts of data driven user research and objectively looking at how to solve for poor performing marketing efforts by appealing to the end consumer. When I was out with my biz-dev hat on I would routinely tell broker-team-agent owners that our product worked well because we developed for the consumer on behalf of the broker-team-agent. This philosophy drove a lot of great product decisions.

On the other side of the coin, we had clients asking for product features like mass texting, which was essentially the ability to text everyone in their database the same message. That’s a terrible experience for a prospective customer and likely to land you on a lot of do not call lists. That’s not an agent need, that’s a highly misdirected want.

All said, it’s really hard to successfully develop a product that appeals to three different customer segments inside a truncated addressable market.

Adoption

My counterpart Rivers wrote a detailed post about adoption problems, please go read that too.

From my simplified perspective, the overall proptech adoption problem is particularly an issue for the traditional brokerage customer segment and is often due to the independent contractor relationships that exist between broker-owners and their teams/agents. Technically speaking, brokerages can’t make their agents or teams use the software they provide and many brokerages have a revolving door of agents coming and going. Less experienced agents are more likely to adopt the broker provided solution, more experienced agents and teams have likely settled into their technology platforms of choice and are difficult to convert. As a result, most brokerages can’t drive adoption rates for a given technology above 30%.

Exceptions are often proptech companies whose product or service is ‘close to the transaction’, i.e. transaction management and back-office software. Brokers can take the stance of “Don’t use our transaction management platform and don’t get paid.” Because that’s literally how the brokerage processes transactions and informs back-office software who gets paid what upon a closing.

Proptech companies will often target traditional brokerages because they see the one-to-many opportunity: sign the brokerage and their constituency will follow. This strategy can work but your company must have significant dedicated resources to walk this path, both in sales and client services, which are expensive. Ideally, the brokerage commits to adoption by dedicating some internal resources of their own to support the initiative. Realistically, this doesn’t go well. A brokerage is in the business of transacting real estate, not training agents on your software.

Also, pricing models can get tricky here. You need to maintain some semblance of pricing integrity or risk cannibalizing revenue. For example, I’ve seen a lot of propetch companies floor their per user pricing based on the total number of users (agents) on the brokerages roster. This can cause a couple of issues. Any current users of your product will want to move to this lower price point; not good for business. Even though the brokerage is paying a significantly reduced cost per user (agent) it’s still a significant expense to a business with thin margins and thus on the perpetual chopping block.

I’ve seen companies trim features to create entry level versions of their product to get them in the door as a ‘check the box’ solution with the hopes of upselling to a fuller featured version. This is also a slippery slope because what likely makes your product valuable is the set of full features. So now you’re putting out a limited version of your product for a lower cost, you lose value integrity and churn spikes compared to the full product. And you still have to train and support the limited product (with less revenue). Some companies will even cut training and support on less calorie rich products, which is a recipe for even higher churn. Now you’re competing strictly on cost and unless that was a well thought strategy to begin with, you’re f*cked.

Who is Your Customer?

The proptech industry’s products have evolved over the years to become what all agents want—an Easy Button (never mind if they will actually push this fictitious button). They want software to do it all, automate the automated, point-click-close. At what point does real estate software become easy enough that consumers can use it successfully alongside a licensed professional to drive down transaction costs? Here are some proptech category examples of the evolution of the Easy Button:

- Property Search – Identifying and recommending properties that a consumer may be interested in used to require a lot of back and forth between an Agent and a consumer to understand not only the desired property characteristics but school and neighborhood information as well. An Agent would have to monitor the MLS to see what was currently and new on the market that met a clients needs and take the time to email them their findings. This all happens automatically today with ubiquitous property search technology.

- Valuation – Assessing how much a home is worth used to take an uncommon level of expertise around comparable property analysis and a lot of long math. Today home values are determined via sophisticated regression models that power Automated Valuation Models (AVM’s), Comparative Market Analysis (CMA’s), and appraisal software. The user interface has gotten as simple as ‘drag and drop’.

- Mortgage pre-approval – Getting pre-approved for a mortgage used to expand your carbon footprint, killing 3 tress worth of paper and shuttling it all through overnight package carriers multiple times to exchange the credit and financial information and all the regulatory docs needed to satisfy everyone’s requirements. Today this can take less than 30 mins using Automated Underwriting Engines and various online data verification services.

- Transaction management – (getting a deal from contract to close) is an exercise in logistical gymnastics that requires the creation and exchange of significant paperwork and scheduling around numerous 3rd parties schedules. Today this is far more efficiently handled through platforms that digitize the entire process. Agents will often pay a transaction coordinator ~$500 per transaction to manage this process for them using these platforms, freeing them up to focus on other things like new business.

As more companies weave AI into their product and those capabilities advance, we’re getting very close to the point where the consumer can drive most of the (especially buy-side) transaction lifecycle—with a licensed agent riding along.

A few examples of note across the current proptech space:

- Zillow is the consumer brand of real estate. This has been their mandate since day 1; own the consumer. Own the consumer, agents will come. As their ‘Super App’ begins to tie in all of the products and services Z offers into a singular experience, who do you think their primary customer is? They will empower the consumer to drive most of the transaction lifecycle. This is in part why they have a $17B market cap (as of 11/14/24).

- I don’t have any experience with SERHANT’s S.MPLE application but it looks pretty sweet. An agent can run a lot of their business from the app. Below are some value propositions around using the S.MPLE app from SERHANT’s website:

- Your Own Team of Experts in Your Pocket – Request marketing materials, CMA’s, listing presentations, or anything else you need as if speaking to your personal assistant.

- Manage your Transactions – Once your accepted offer lands, your Transaction Management Advisor takes over — handling every detail, deadline, and document, so you don’t have to.

- Advanced Tech with a Human Touch – Interact with full-time SERHANT. Advisors which combine their real estate expertise with mastery over internal systems to manage your requests from start to finish.

S.MPLE is only for agents with SERHANT, but It’s easy to see how a consumer could work within an app like this and drive the transaction lifecycle.

- Similar to S.MPLE, Sidekick is an application that appears to make typically complicated tasks easy using real estate data and generative AI. A couple value propositions from their website:

- Be a market expert – Ask Sidekick to pull insightful market data from your MLS in an instant.

- Generate standout CMAs in seconds with Sidekick doing the heavy lifting.

- Analyze and Summarize Documents – Contracts, spreadsheets, you name it. Sidekick can extract the information you need.

What do these examples have in common? Their value propositions could just as easily be positioned at the consumer (and an agent).

Think Different

Skate to where the puck will be. Pitch the basketball through the goalposts and score a touchdown… or something like that. With the decoupling of real estate commissions increasing opportunistic competition and the advent of agentic Artificial Intelligence, there is an opportunity to think different with regards to how and who proptech products are developed for.

If I’m a forward looking proptech company or a really forward looking brokerage, I’m scheduling more than one strategy session to figure out how we tightly weave the consumer into the user experience and delight them in the process. Give the consumer enough transparency and access so that a brokerage-team-agent is an unquestioned, unassailable fiduciary.

What’s the upside? Win the consumer, win the brokerage-agent-team. Break through TAM ceilings. Solve adoption problems. Spend less time and resources serving multiple masters. Align pricing/revenue models with successful outcomes to supplement recurring fees.

This post was a written from a 30,000 foot perspective. In my next post I’m going to detail how consumer-enabled technology could work around the offer and negotiation phase of the real estate transaction lifecycle, driving down transaction costs and delighting the consumer in the process.