Real Estate Darwinism: Evolution, Then Revolution

By Jeff Corbett

Background

The Settlement

The recent landmark antitrust settlement (Settlement) between the National Association of Realtors and the greater real estate industry that is aligned under the trade organization requiring agents to negotiate their fee for services with buyers upfront rather than be paid through a unilateral offer set by the seller(s agent) represents both a subtle change and a seismic shift across the industry.

I wrote in December of 2020 that if the plaintiffs in these lawsuits won, thereby divorcing (or decoupling) buy and sell side commissions:

“…the implications for the real estate sales industry would facilitate more transformative change than any technology-based innovation.”

The hypothesis evolves…

Generative AI

Limited memory, generative AI (GENAI) models, first deployed at scale in late 2022, are capable of processing enormous volumes of information, learning from past interactions, and adjusting their output to better serve the user. It’s hard to find a technology company that isn’t weaving the golden thread of GENAI into their products. Evolutions of GENAI models happen fast, with the latest OpenAI model performing chain of thought reasoning much like a human does. More on this below.

Background

The Settlement

The recent landmark antitrust settlement (Settlement) between the National Association of Realtors and the greater real estate industry that is aligned under the trade organization requiring agents to negotiate their fee for services with buyers upfront rather than be paid through a unilateral offer set by the seller(s agent) represents both a subtle change and a seismic shift across the industry.

I wrote in December of 2020 that if the plaintiffs in these lawsuits won, thereby divorcing (or decoupling) buy and sell side commissions:

“…the implications for the real estate sales industry would facilitate more transformative change than any technology-based innovation.”

The hypothesis evolves…

Generative AI

Limited memory, generative AI (GENAI) models, first deployed at scale in late 2022, are capable of processing enormous volumes of information, learning from past interactions, and adjusting their output to better serve the user. It’s hard to find a technology company that isn’t weaving the golden thread of GENAI into their products. Evolutions of GENAI models happen fast, with the latest OpenAI model performing chain of thought reasoning much like a human does. More on this below.

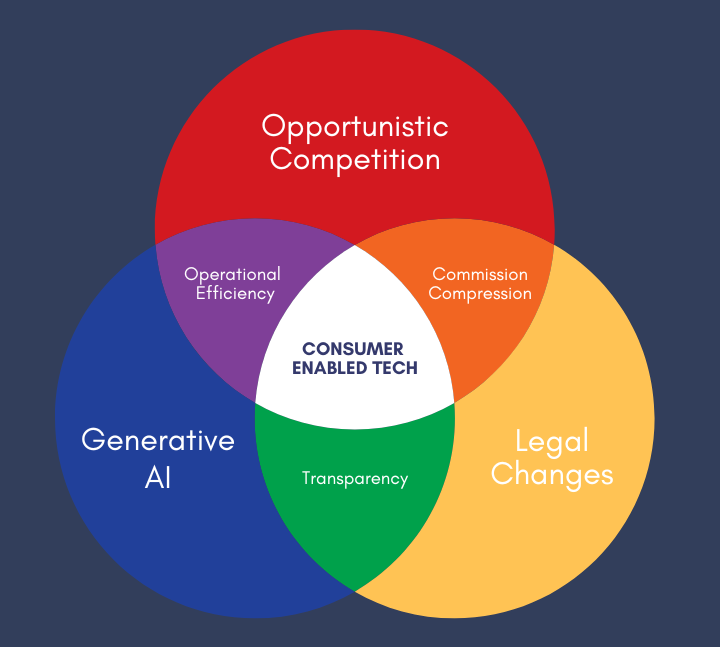

The combination and timing of the Settlement and the advent of GENAI represents a quantum leap of raw capability for competitive, disruptive forces to impact the greater real estate industry. As these new capabilities ripple their way through the landscape, the disruptive evolutions will start small and slow, but make no mistake, they will lead to revolutionary changes.

Opportunistic Competition Cometh

With this administrative change around when and how buyers agent fees must be disclosed and paid, opportunistic competition shall cometh… both from new entrants and adaptable incumbents. It is the natural order of an open marketplace.

Let’s start with looking at the historical landscape for potential new entrants on the buy side of a real estate transaction. I’m focusing on buy side in this article because the sell side of real estate is simply a different business with different requirements, expenses, expectations, etc. But we’ll get to that in another article.

A series of small scale polls administered by respected industry pundits/thought leaders since the Settlement suggest that 40%+ of consumers feel that ‘typical buyers agents fees’ (~2.5%) do not align with the value of services they received (contact me and I will send you any polls referenced in this article, as many of them are behind paywalls or were shared during live events). In other words: they would like to pay less. Alternative commission model brokerages have been launched too many times to count over the years in an effort to meet this consumer demand. Apart from a few exceptions, they have consistently failed as a model.

Why? They have been historically positioned as ‘inferior’ at best and boycotted at worst, like Homie, a real estate brokerage licensed in Utah and Arizona.

In Homie’s legal complaint filed 8/22/24, they allege some pretty damning behavior coming from other local agents:

Section 68

“Local NAR members in Utah used Facebook groups to coordinate boycotts of Homie’s listings with low buyer-broker commissions during the period that the Buyer-Broker Compensation Rule was in effect, sometimes marked with the hashtag “#boycottHOMIE.” One such Facebook group was called the Wasatch Front Agents group, which had over a thousand members. On these Facebook groups, brokers exchanged information about their intent to steer buyer clients away from properties listed by Homie for sale in Utah. For example, one post stated: “I know several agents that omit [H]omie listings from their hotsheets. They would be wise to counsel their sellers on the affect [sic] of such low BAC.”

There are also a number of emails, texts, and comments in the local multiple listing service that scream exclusionary steering. Ugh.

I believe that in a post Settlement landscape and with cases like Homie likely triggering a new wave of litigation against similar bad actors, alternative commission model brokerages will have a better chance to compete. Unfortunately, conspired ostracizing of such models is likely to continue in some part until the liability of doing such has a dollar amount attached to it.

A big challenge for all of these new companies will be how to reach and convert a customer at a palatable cost, but that too is for another post.

While new entrants are where most folks are looking for heightened levels of competition to come from, I believe the competition from adaptable incumbents will significantly outpace new entrants’ ability to reach and convert a customer. Why?

First, they likely have a lot of potential customers in their CRM or like databases and are actively generating new prospects from various marketing channels, mitigating those acquisition costs compared to a new entrant. Second, entrepreneurial agents and brokerages will naturally begin to compete on price because (a) they can; and (b) it will begin to win them more business more often.

Maybe it’s too soon to run out and openly advertise ‘I charge less!’. Many of their peers will give them the stink eye, likely subject them to bullying on the socials, and some hard core mo-fo’s may choose to refuse to bring their offers to their sellers for consideration because of this transgression (yes, that’s illegal, but this is still real estate). I applaud those who choose not to care and push forward, but understand that this fear of ostracization is still very real. Remove friction wherever you can, right?

So, maybe it’s more nuanced. Agents could highlight that they are only charging [insert something less than 2.5%] when presenting their agency agreement to a buyer, which starts to successfully convert more clients than the typical 2.5%-3% rate, which leads to more clients, which leads to… you get it.

Maybe it’s even more subtle than that… Offering up a buyers agency agreement that is amenable to charging less than the agreed upon buyers agent fee in such instances that a seller won’t pay enough in concessions to cover the full amount. Maybe it’s something really cool that I don’t even know about.

If agents can move past the narrative still coming from those seeking to preserve the pre-Settlement landscape and understand that they can continue to operate a thriving business by competing on price, they’ll find there is opportunity to meet the demand coming from those 40%+ of consumers mentioned above. Granted, they’ll need to leverage technology to enable efficiency like never before. Fortunately, technology has recently evolved to meet the challenge.

If agents can move past the narrative still coming from those seeking to preserve the pre-Settlement landscape and understand that they can continue to operate a thriving business by competing on price, they’ll find there is opportunity to meet the demand coming from those 40%+ of consumers mentioned above. Granted, they’ll need to leverage technology to enable efficiency like never before. Fortunately, technology has recently evolved to meet the challenge.

The combination and timing of the Settlement and the advent of GENAI represents a quantum leap of raw capability for competitive, disruptive forces to impact the greater real estate industry. As these new capabilities ripple their way through the landscape, the disruptive evolutions will start small and slow, but make no mistake, they will lead to revolutionary changes.

Opportunistic Competition Cometh

With this administrative change around when and how buyers agent fees must be disclosed and paid, opportunistic competition shall cometh… both from new entrants and adaptable incumbents. It is the natural order of an open marketplace.

Let’s start with looking at the historical landscape for potential new entrants on the buy side of a real estate transaction. I’m focusing on buy side in this article because the sell side of real estate is simply a different business with different requirements, expenses, expectations, etc. But we’ll get to that in another article.

A series of small scale polls administered by respected industry pundits/thought leaders since the Settlement suggest that 40%+ of consumers feel that ‘typical buyers agents fees’ (~2.5%) do not align with the value of services they received (contact me and I will send you any polls referenced in this article, as many of them are behind paywalls or were shared during live events). In other words: they would like to pay less. Alternative commission model brokerages have been launched too many times to count over the years in an effort to meet this consumer demand. Apart from a few exceptions, they have consistently failed as a model.

Why? They have been historically positioned as ‘inferior’ at best and boycotted at worst, like Homie, a real estate brokerage licensed in Utah and Arizona.

In Homie’s legal complaint filed 8/22/24, they allege some pretty damning behavior coming from other local agents:

Section 68

“Local NAR members in Utah used Facebook groups to coordinate boycotts of Homie’s listings with low buyer-broker commissions during the period that the Buyer-Broker Compensation Rule was in effect, sometimes marked with the hashtag “#boycottHOMIE.” One such Facebook group was called the Wasatch Front Agents group, which had over a thousand members. On these Facebook groups, brokers exchanged information about their intent to steer buyer clients away from properties listed by Homie for sale in Utah. For example, one post stated: “I know several agents that omit [H]omie listings from their hotsheets. They would be wise to counsel their sellers on the affect [sic] of such low BAC.”

There are also a number of emails, texts, and comments in the local multiple listing service that scream exclusionary steering. Ugh.

I believe that in a post Settlement landscape and with cases like Homie likely triggering a new wave of litigation against similar bad actors, alternative commission model brokerages will have a better chance to compete. Unfortunately, conspired ostracizing of such models is likely to continue in some part until the liability of doing such has a dollar amount attached to it.

A big challenge for all of these new companies will be how to reach and convert a customer at a palatable cost, but that too is for another post.

While new entrants are where most folks are looking for heightened levels of competition to come from, I believe the competition from adaptable incumbents will significantly outpace new entrants’ ability to reach and convert a customer. Why?

First, they likely have a lot of potential customers in their CRM or like databases and are actively generating new prospects from various marketing channels, mitigating those acquisition costs compared to a new entrant. Second, entrepreneurial agents and brokerages will naturally begin to compete on price because (a) they can; and (b) it will begin to win them more business more often.

Maybe it’s too soon to run out and openly advertise ‘I charge less!’. Many of their peers will give them the stink eye, likely subject them to bullying on the socials, and some hard core mo-fo’s may choose to refuse to bring their offers to their sellers for consideration because of this transgression (yes, that’s illegal, but this is still real estate). I applaud those who choose not to care and push forward, but understand that this fear of ostracization is still very real. Remove friction wherever you can, right?

So, maybe it’s more nuanced. Agents could highlight that they are only charging [insert something less than 2.5%] when presenting their agency agreement to a buyer, which starts to successfully convert more clients than the typical 2.5%-3% rate, which leads to more clients, which leads to… you get it.

Maybe it’s even more subtle than that… Offering up a buyers agency agreement that is amenable to charging less than the agreed upon buyers agent fee in such instances that a seller won’t pay enough in concessions to cover the full amount. Maybe it’s something really cool that I don’t even know about.

If agents can move past the narrative still coming from those seeking to preserve the pre-Settlement landscape and understand that they can continue to operate a thriving business by competing on price, they’ll find there is opportunity to meet the demand coming from those 40%+ of consumers mentioned above. Granted, they’ll need to leverage technology to enable efficiency like never before. Fortunately, technology has recently evolved to meet the challenge.

Proptech and the Shift Toward Consumer Enablement

Below is an unedited list that was shared by a respected broker-owner at a recent industry event of the jobs buyers agents perform for clients to outline the value that they provides to a client:

Buyers Agent Jobs to Be Done

Consultation Milestones and Action Items

- Home Requirements

- Capture Home Requirements

- Buyer/Broker Agreement

- Discuss Rules of Engagement

- Explain the Buying Process

- Buyer Broker Agreement Signed by Both Parties

- Financing Options

- Discuss Mortgage and Cash-Buying Options

- Discuss Potential Impacts to Credit Score

- Record Purchase Budget

- MLS Search

- Set Up MLS Search

Contract Milestones and Action Items

- Open Escrow

- Earnest Money Deposit

- Determine EMD Due Date

- Advise Client on Requirements

- Get Confirmation of Escrow

- Account Funding

- Disclosures

- Receive Property Disclosures

- Discuss Disclosures with Client

- Home Inspection

- Get Inspection Date

- Get Inspection Report

- Discuss Report with Client

- Termite Inspection

- Get Inspection Date

- Get Inspection Report

- Discuss Report with Client

- Appraisal

- Get Appraisal Date

- Get Appraisal Report

- Discuss Appraisal with Client

- Moving Details

- Provide Utility Transfer Instructions

- Provide Mail Forwarding Instructions

- Provide Vendor Service Information

- Final Walkthrough

- Schedule final walkthrough

Touring & Offers Milestones and Action Items

- Tour the Home

- Capture Home Requirements

- Review the Home

- Get Client’s Feedback

- Evaluate the Home

- TBD

- Make an Offer

- Set Up MLS Search

Closing Milestones and Action Items

- Funding

- Loan Closing Disclosure Statement Requested

- Loan Closing Disclosure Approved & Signed

- Closing Document Signing Scheduled

- Final Walkthrough Scheduled

- Loan Documents Sent to Escrow/Title for Preparation

- Arrange Closing Signing for Final Document Signatures

- Attend Final Walkthrough

- All Cash Received and Financing Funded

- Home Purchase Recorded and Closed

- Utilities

- Instructions and Utilities Transfer Complete

- Transactions and Mail Forwarding Setup Completed

- Final Items Removed from Client Home Information Binder

- Moving

- Pickup keys, remotes, and other home information

- Deliver Keys, Remotes, and Other Items for New Homeowner

- Prepare Full Transaction Record

- Closing Report and Outstanding Items Reviewed

- Client Feedback Gathered / Home Journey Complete

Avg. # Hours: 87 to complete

Avg. # Days: 56 to complete

Avg. # Activities: 114 complete

Avg. # Outcomes: 202 complete

(Note: I didn’t calculate the # of days, hours, activities, outcomes)

Back in the days of the rolodex, fax machine, snail mail, MLS books, and non-mobile phones… getting a client from search to close was a comparatively herculean task. Then the internet came along and many predicted the end of the real estate agent, or at least extreme disintermediation.

Back in the days of the rolodex, fax machine, snail mail, MLS books, and non-mobile phones… getting a client from search to close was a comparatively herculean task. Then the internet came along and many predicted the end of the real estate agent, or at least extreme disintermediation.

Turns out the internet didn’t end the agent, rather, it drove innovation that empowered the agent. Literally hundreds of billions of investment dollars have been poured into thousands of companies over the past two+ decades to streamline their workflows, automate simple redundant tasks and otherwise make the above jobs to be done far more efficient for an agent to complete. This is the property technology (proptech) industry as we know it today.

Turns out the internet didn’t end the agent, rather, it drove innovation that empowered the agent. Literally hundreds of billions of investment dollars have been poured into thousands of companies over the past two+ decades to streamline their workflows, automate simple redundant tasks and otherwise make the above jobs to be done far more efficient for an agent to complete. This is the property technology (proptech) industry as we know it today.

Many practitioners in the industry are still stuck in the status-quo way of thinking. For example, I see agents gravitating towards showing potential clients everything they do due to these new requirements and because recent surveys have shown that many consumers can’t explain the value of a buyers agent.

IMO, buyers agents who try to substantiate their value by showing clients that they sent a lot of texts and emails, where they drove, how they received and forwarded an inspection and other reports are missing the mark. You don’t get a ⭐ for doing what you’re supposed to do, you get one for exceeding expectations in efficiency and bottom line results. Aside from tightening current operational screws and upping the hustle, how does the industry begin to truly deliver a better consumer experience for less cost? Let me hypothesize a bit…

I believe the proptech and brokerage industries are now primed for a shift, specifically around who their products and services engage. Why now? a) Opportunistic competition and the need to get operationally efficient as a result; b) We are currently in the midst of substantial evolution with regards to how technology analyzes data and actually executes on tasks.

The launch of OpenAI’s ChatGPT in November of 2022 was the seminal moment in the advancement and application of artificial intelligence in terms of its unprecedented ability to understand and generate human-like text and in its availability to the general population. Advancement/improvement of OpenAI’s original model (and various others) hasn’t been iterative like typical software development cycles, it has been exponential, because it learns.

On September 12th, 2024 OpenAI released model o1, a “model trained with reinforcement learning to perform complex reasoning.” Model o1 mimics how human train of thought works and yields PhD level results. This is an incredibly substantial evolution. According to experts, AI Agents are next. Soon you will be able to give AI Agents an objective and they will break that objective down into tasks and then work to complete each of those tasks.

Running these rapidly advancing models and eventually ‘Agentic Reasoning’ on top of the vast amounts and types of real estate data required to shepherd a real estate transaction from search to close will have a transformative, dare I say, revolutionary effect on the future of proptech and real estate brokerage as an industry.

What once required a buyers agent’s direct involvement will be primarily driven by the consumer, with nuanced assistance from a buyers agent.

Let’s unpack my statements a bit a lot further and look at the buyers agents jobs to be done that will be completed by AI Agents that are integrated within proptech companies products that service the transaction lifecycle. To be clear, I’m not throwing around some highly aspirational, dystopian ideas here. This isn’t some crazy science fiction sh*t. These things are executable with today’s science.

Property Search

Assisting clients in browsing available properties by analyzing their preferences and automatically suggesting suitable homes, recommending properties based on location, budget, school districts, and other preferences. This is already happening at cursory levels at companies like FlyHomes. The experience will quickly become far more refined.

Scheduling Property Tours

AI agents will manage property tour bookings by coordinating schedules between clients and sellers’ real estate agents. This includes sending reminders, confirming appointments, and adjusting based on availability.

I believe physical property tours will end up being a job that sellers agents primarily perform. If your value proposition as a buyers agent is positioned right and you have a proper buyers agency agreement signed, the buyers agent should be at low risk of a sellers agent successfully poaching the buyer. I also believe dual agency has a shelf life. Another topic for another post.

Comparative/Buyer Market Analysis

Creating a CMA can be time consuming, especially if they are comprehensive and require near real-time information to be accurate and actionable. What aspects can AI Agents improve upon?

- Automated Data Aggregation: Automatically gather data from multiple sources such as MLS listings, public records, and third-party databases, ensuring comprehensive and up-to-date information.

- Real-Time Updates: Market changes tracked in real-time, updating CMAs as new listings or sales occur.

- Enhanced Comparables Selection: AI models can more precisely match comparable properties by considering a wider array of factors, including neighborhood dynamics and amenities.

- Macro-Market Trends: Forecast future market conditions by examining economic indicators, helping set prices that anticipate market movements.

- Micro-Market Analysis: Provides insights into hyper-local trends that can affect property values, such as upcoming developments or zoning changes.

- Sensitivity Analysis and Pricing Strategies: AI can model how different listing prices may affect time on market and final sale price.

- Risk Mitigation: Flag potential issues like overpricing or market saturation.

- Buyer Behavior Analysis: Analyze online search trends and social media to gauge buyer interest in specific areas or property types.

- Immediate Responses: AI-powered assistants can answer client queries promptly and accurately.

Inspection and Maintenance Analysis

Most agents are not as well versed as contractors when it comes to assessing needed property repairs and cost estimates for such. AI can bridge that gap. Analyzing and interpreting inspection reports with a high degree of accuracy is also critical to submitting well informed offers.

- Defect Identification: Analyze photos from inspections to detect defects like cracks, mold, or leaks that might be missed during a manual review.

- Condition Assessment: Automatically assessing the condition of building components from images, enhancing the thoroughness of inspections.

- Risk Assessment: Estimating the likelihood of future issues (like system failures or structural problems) to prioritize repairs and allocate resources.

- Marketability Impact: Analyzing how maintenance and repair decisions might affect property value or marketability.

Offer Generation

Offer generation and negotiation is probably the most highly subjective and nuanced aspect of the transaction lifecycle. It can also be one of the most time-consuming. It’s fascinating (to me) how this process could be facilitated by advanced AI Agents to support both the buyer and the future human buyers agent.

- Personalized Offer Recommendations:

- Buyer’s Financial Profile: Assess the buyer’s financial situation, loan pre-approval status, and risk tolerance to suggest suitable offer prices and terms.

- Seller’s Motivation Analysis: By analyzing language used in listings and communications to gauge the seller’s openness to negotiation, as well as, data points like the property’s time on market and any price changes, AI can infer the seller’s urgency to sell and recommend appropriate offer strategies.

- Market Trend Prediction:

- Price Trajectory Forecasting: Predict short-term and long-term price movements in the area, helping buyers decide on the timing and aggressiveness of their offers.

- Demand Analysis: Assesses buyer activity levels to determine the competitiveness of the market.

- Property-Specific Insights:

- Scenario Modeling and Simulation:

- What-If Analysis: AI can simulate various negotiation scenarios, showing potential outcomes of different tactics like appraisal gaps, earnest money amounts, escalation clauses, and contingency waivers, all dependent on local market conditions.

- Risk Assessment: Evaluates the potential risks and benefits associated with each negotiation tactic, helping buyers make informed decisions.

- Automated Drafting of Offer Documents:

- Customized Contracts: Generate offer letters and contracts that include necessary legal clauses, tailored to the specific transaction and jurisdiction.

- Clarity and Compliance: Ensure all terms are clearly stated and that documents comply with local real estate laws and regulations.

- Optimal Contingency Selection: Recommends which contingencies to include or waive based on risk analysis and market conditions. Also evaluates the legal implications of waiving certain contingencies, ensuring the buyer is aware of potential liabilities.

- Real-Time Advice:

- Interactive Support: AI-powered assistants can provide advice during negotiations, suggesting counteroffers or responses to seller proposals.

- Emotion Recognition: Some advanced models can interpret the emotional tone in communications, advising on the best approach to maintain a positive negotiation climate.

- Transparency:

- Explainable AI: Provides clear explanations for its recommendations, allowing buyers and agents to understand the rationale behind them.

- Buyer Autonomy: Enable users to make final decisions, using AI as a tool rather than a replacement for human judgment.

Final Offer is a company making early strides in providing greater transparency around the offer process. The number one reason more agents and brokers don’t choose to adopt the platform? It’s a bit too transparent. 🤦

- Regulatory Compliance:

- Contract Review: Ensures all contractual documents meet legal requirements and adhere to ethical standards.

- Fair Housing Compliance: Monitors communications and offer terms to prevent unintentional violations of fair housing laws.

Transaction Coordination

Overseeing the administrative tasks required to move a real estate deal from an accepted offer to a successful closing can be quite the juggling act. Let’s consider some of the major steps to coordinate a transaction through the lens of AI assistance that could displace transaction coordination services that many agents pay ~$500 per transaction for:

- Automated Document Generation:

- Smart Templates: Use predefined templates to auto-populate contracts with property details, party information, and standard clauses, reducing manual entry errors.

- Dynamic Clause Inclusion: AI models can include or exclude clauses based on transaction specifics, such as financing terms or contingencies.

- Error Detection: AI scans closing documents for errors or omissions.

- Compliance Assurance: Verifies that all documents comply with federal, state, and local regulations.

- Contract and Disclosure Review:

- Natural Language Processing (NLP): AI can analyze contracts to identify inconsistencies, missing information, or non-compliant language.

- Risk Flagging: Highlights potential legal issues or unfavorable terms that may require attention.

- Process Scheduling and Reminders:

- Smart Calendaring: AI coordinates availability between buyers, sellers, inspectors, appraisers, attorneys etc. to find optimal times for all.

- Automated Reminders: Sends notifications to all parties about upcoming inspections.

- Automated Alerts: Notifies relevant parties of upcoming contingency deadlines (e.g., inspection, financing, appraisal).

- Progress Monitoring: Tracks completion of contingency tasks and updates status in real-time.

- Appraisal Report Review:

- Consistency Checks: Ensures that the appraisal aligns with market data and identifies any discrepancies.

- Compliance Verification: Confirms that the appraisal meets industry standards and regulatory requirements.

- Closing Disclosure Management:

- Accuracy Verification: Ensures all financial details are correct and match previously agreed terms.

- Timely Delivery: Automates the delivery of the Closing Disclosure to meet the mandatory review period.

While this phase of weaving AI agents into a proptech companies products may initially take the form of next generation agent efficiency tools, companies ought to consider more of a blue ocean strategy of enabling consumers to confidently drive much of the home buying process. If you’re part of a proptech company, this could fundamentally change your business model to appeal to a wider addressable market. Imagine moving away from (agent) seat based pricing models into event or outcome driven pricing. 🤔

Conventional wisdom says you can’t compete on cost and service… gotta pick one. These are unconventional times. As AI models and opportunistic competition continues to evolve, there seems to be the opportunity to grab market share by addressing both cost and how to best service a customer. Human buyers agents who embrace this shift can position their value by providing nuanced advice, especially in complex negotiations, unique property and market conditions, and personalized empathetic guidance that technology alone cannot fully replicate. They can be highly competitive with solid margins because they are operationally efficient and exceed the consumers expectations by offering a transparent, consumer enabled experience.

I’m sure this all sounds very familiar. Disruption/disintermediation on this level has been forecasted for 20+ years. Just a year ago, the idea of developing consumer enabled products would have been laughable given how agents could ensure commission rates via unilateral offers of compensation. There was no incentive for proptech companies to think about the consumer experience in meaningful ways.

An Environment Set For Revolution

As competitive forces increase and commission rates compress, creating products that allow the consumer to drive the buying process represents a massive opportunity for those in the proptech (and greater real estate) industry. You can be sure that there are several companies in the industry already working on aspects of an AI-driven buyer’s experience in the vein of this article’s context, both incumbents and new entrants alike.

If innovation is perhaps a more deliberate and faster form of evolution, then legal mandated changes + opportunistic competition + GENAI powered innovation is perhaps a faster path to revolution.

Will you be amongst the fittest?

The recent landmark antitrust settlement (Settlement) between the National Association of Realtors and the greater real estate industry that is aligned under the trade organization requiring agents to negotiate their fee for services with buyers upfront rather than be paid through a unilateral offer set by the seller(s agent) represents both a subtle change and a seismic shift across the industry.

The recent landmark antitrust settlement (Settlement) between the National Association of Realtors and the greater real estate industry that is aligned under the trade organization requiring agents to negotiate their fee for services with buyers upfront rather than be paid through a unilateral offer set by the seller(s agent) represents both a subtle change and a seismic shift across the industry. With this administrative change around when and how buyers agent fees must be disclosed and paid, opportunistic competition shall cometh… both from new entrants and adaptable incumbents. It is the natural order of an open marketplace.

With this administrative change around when and how buyers agent fees must be disclosed and paid, opportunistic competition shall cometh… both from new entrants and adaptable incumbents. It is the natural order of an open marketplace.